Open Letter To

Jim Cramer

Thanks for the call

for 'perp walks'

(2009 Jan 07)

Poke me.

Open Letter To

|

Poke me. |

(2009 Feb blog post)

! Note !

A few more web links and some quotes of financial

'perps' may be added as they continue

in their extremely harmful behavior ---

if/when I re-visit this page.

They just don't get it. The country simply cannot

afford their continuing shenanigans.

They've severely crippled the middle class and

aged and young, who were their meal ticket.

They kill the geese who lay golden eggs.

|

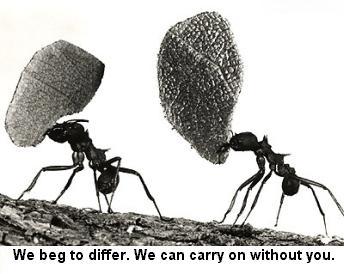

Dear Jim Cramer : I was watching your show the night of 2009 Jan 07 when you spoke out in favor of using the RICO (Racketeering) Act to go after investment bankers "who are the crooks we all know they are". THANK YOU !!! Thanks for calling for a "Marianna's trench of subpoenas". Thanks for speaking out so strongly. Example: "I want to see some perp walks." Thanks for expressing your outrage and asking for "heads to roll". I was planning on writing a letter of thanks and encouragement right after that program, but I kept putting it off. What prompted me to write was Rick Santelli's tirade yesterday (2009 Feb 19) in which he blamed people re-doing their bathrooms for the 2008-2009 financial meltdown. Mis-directed --- way, way off-target. I saw Santelli's tirade on Squawk Box this morning (2009 Feb 20). The co-hosts of that program encouraged emails to squawk@cnbc.com, so I wrote a response (link here). In my response to Squawk Box, I list a bunch of outrages. I think that some correspond to some that you have mentioned on your show. Maybe some of my outrages could trigger you to think of more outrages to add to your list. It would be helpful to have a weekly recapitulation of your list of outrages --- along with a weekly perp-award to a monkey-business-person --- until this mess is behind us. Unfortunately, this type of economic super-mess will recur. Look what happened to Christ after he chased the money-changers out of the temple. The horrible financial actors are always in a position to come back. And they're certainly back now --- with their hands in OUR pockets. Not a pleasant thought. Here is a riddle for you. What professional sport is most like the U.S. financial system? The answer is below this picture. |

|

Answer: Professional Wrestling. There are very few rules, and none of them are enforced. (Sound familiar?) Think about all the professional sports --- football, baseball, basketball, soccer, tennis, rugby, volley ball, badminton, Texas hold-em, chess, etc. etc. They all have rules --- and they have referees and umpires. Even Ultimate Fighting. Talk about transparency --- most of these sports are on television where any helmet-tackles, elbowing, tripping, clothes-lining, low blows, etc. are quite likely to be seen by the audience as well as the referees. In contrast, look at the U.S. financial system --- and most of our politicians and many of our economists. In spite of the fact that these CEO's had access to billions, even trillions, of other people's money, nationally known politicians and economists claimed that these people could police themselves. Come on, Alan Greenspan. Where is your common sense? When you were a boy, didn't you realize that if you and a bunch of your friends were left in a candy store overnight after being told not to eat any of the candy, at least one or two in the bunch would help themselves. Just because they've grown up now doesn't mean that the same thing can't happen --- especially when there are BILLIONS of dollars involved. It's one heck of a candy store they are in. At recent testimony in Congress, at least one Congress-person remarked that "Consumer confidence is at a record low" and "Business confidence is at a record low". They also say, repeatedly, that we have to get credit flowing again. I believe that most of this lack of confidence is due to the unprecedented levels of moral terpitude of the financial kind --- with no apparent progress toward rooting out those who are responsible and making sure they are not in a position to repeat their sociopathic behavior, which is now a habit. One very real way we see this lack of confidence is that banks are still reluctant to lend to each other. They know they can't trust their fellow CEO's and other financial executors. I can't help but pause here and note that I am always amused when I hear your tirade on Sarbanes-Oxley --- "How can we have these levels of fiction in financials after Sarbanes-Oxley?" I saw the Sarbanes-Oxley Act being implemented in our company a few years before I retired. Every supervisor in the computer systems area was tasked to write up documents on procedures, and most of us had to read them. What a variety of documents! Apparently, no one had given them any models to follow, and the goals were not clearly laid out. In any case, Sarbanes-Oxley does not seem to have any prosecutorial teeth in it --- at least, not to deal with the practices that were largely responsible for this meltdown. No doubt compromises had to be made to get the bill through Congress. The financial sociopaths are still in the system. (Talk about a systemic problem!!) The public recognizes this. Unfortunately, it is a huge expense to track these people down and gather evidence of their mis-deeds. Unfortunately, too, there are holes in the laws that make it almost impossible to bring these people to what most people can agree is a just outcome. I personally prefer public stonings. One stone for each $1,000. For some, the end result would be no more than a puddle of protoplasm. In spite of the expense of gathering enough evidence to successfully prosecute these 'financial perps', I think it is worth it. It would take a relatively small percentage of the trillion-plus in 'Great Recession' bailout money to fund the FBI and Justice Department to gear up for a hunt for these people and their foreign bank accounts. One obvious place to start is to trace the source of those ads that said "Bad credit? Bankruptcy? No problem. We will give you a loan. No money down. No interest for 12 months." You can bet that most of those people were so greedy that they did not pay anywhere near the tax due on that income. |

|

In conclusion : Keep up the good work in calling out financial perps, Cramer. I have been surprised that the producers at CNBC have allowed you and Dylan Ratigan to express such thoughts (the need for prosecutions of these white-collar crimes) on your respective shows. The reason I am surprised that they allow a call for 'white collar perp walks' is that I used to watch some of the Larry Kudlow show, after your show. The producers seem to encourage the most outrageous views and behaviors (financially irresponsible predatory behaviors) in that show, and quite a few other CNBC shows. I cannot stand to watch Kudlow and friends any more though. Predatory lending is just the American way according to him and his friends. Also, I got tired of seeing Kudlow using his three basic ways of cutting off people who did not support his 'let them prey' views

And Charlie Gasparino was particularly annoying in talking over people. Even some of the other CNBC hosts would point it out sometimes, it was so rude to the guest. Kudlow and friends just don't get how they project. Television is like a big magnifying glass. Just like they say television makes one look fatter, it also makes it quite obvious when they use heavy-handed tactics to 'spin' the news. I am glad that you, Cramer, seem to sincerely try to avoid that nonsense. You seem to have more respect for your viewers. You seem to understand that some of your viewers may be the next Thomas Edison (1% inspiration and 99% perspiration). Kudlow seems to be interested in incubating the next generation of scam artists and get-rich-quick schemes. Keep fighting the good fight. I hope the President and the Justice Department and the Treasury Department take to heart the "perp walk" message, even though they cannot use that particular phrasing publicly. A concerned citizen. |

|

For more info Here is an address and links for CNBC.

To find some more info on the subject of 'financial perpetrators', you can try a WEB SEARCH on keywords such as: and |

|

Bottom of this page on an

To return to a previously visited web page location, click on the

Back button of your web browser, a sufficient number of times.

OR, use the History-list option of your web browser.

< Go to Top of Page, above. >Or you can scroll up, to the top of this page. Page history

Page was posted on 2009 Feb 20.

|