The Occupy

(Wall Street and other

banking locations)

Movement, 2011

Some concerns on violence

and on banking practices.

|

The Occupy

Some concerns on violence |

|

(2011 Nov blog post)

|

INTRODUCTION: I was recently sent a link titled 'Things Are Getting A Bit Wild At Occupy Oakland' at businessinsider.com. It showed pictures of broken windows at several bank branches. I think it is disgusting when people do destructive things like that --- like when Greek rioters in 2011 were breaking off chunks of ancient buildings to get projectiles to throw --- and when the 'anti-social elements' in Vancouver rioted (in 2011) and burned vehicles and looted stores when their hockey team lost in the Stanley Cup finals. They are generally making matters worse in such situations. What good comes from destroying cars, windows, buildings? If they were being replaced by greenery, there might be some good to come of it. Get angry and plant a tree, anti-civilization people! How about an aggressive act of kindness? I do not think such 'destroyers' should be allowed to live in civilized society. Two strikes (maybe three, in extenuating/mild circumstances). After that, they should be deported --- say, parachuted onto one of the Aleutian Islands (with a bottle of water and a blanket), if they were burning or looting or destroying in the U.S.A. (With a pledge of non-destructive behavior --- and 5 years on the island, they could return. Next offense --- life.) On the other hand, at the same time that I am disgusted with the destruction, I know that in the case of 'Occupy Oakland' (since I know someone who lives in Oakland), the 'destroyers' are less than 1% of the people among the 'Occupy Oakland' demonstrators. (Some might even be government 'plants' --- like in the Vietnam War demonstrations of the late 1960's.) The 'liberal' media (That's a joke. It hardly exists in the U.S.A. in 2011.) and other media are not showing the MANY-MANY-MORE peaceful people (the 99%) trading experiences with each other and showing placards that voice their concerns. Those major aspects of the 'occupy' demonstrations are scarcely shown because that is not newsy enough for the media --- and probably does not convey what the media owners and managers wish to convey. The media are not showing that many 'occupiers' are trying to stop the destruction, whenever they have an opportunity to intervene.

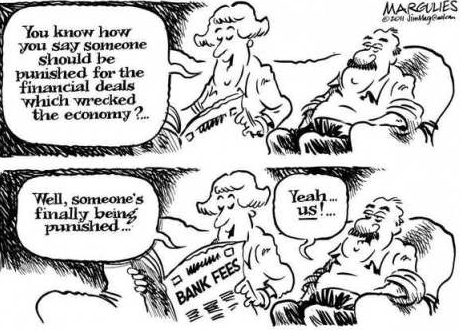

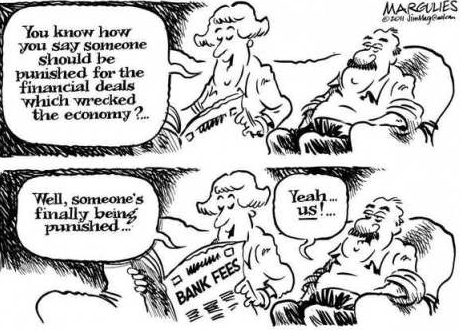

Of Much More Concern :

ONE. Our deposits will be channeled into covering THEIR 'investments' (= riskier-than-LasVegas-gambling) that can now be executed through the new BofA Merrill Lynch subsidiary (the result of a 'meltdown'-forced sale to BofA). No doubt about it --- our deposits will be used to 'cover' when those investments go bad (which is quite probable in the current world economic climate). [NOTE that BofA would not have been allowed to acquire Merrill-Lynch, according to laws passed after the Great Depression --- laws to prevent the mixing of stock-gambling with bank-deposits. But the idiot Republican-controlled Congress --- with the help the President (Clinton) --- eliminated those protections in 1999.]

TWO.

THREE. These bank executives are the same people who tout 'free enterprise' and 'very little to no regulation'. They are the ones who gambled and lost. In a true 'free enterprise' and 'survival of the fittest' economy, they should NOT be given a HUGE BAILOUT by taxpayers. But since they are being given a huge bailout by 'us', they should not be gouging us every way they can think of. For example, there is the recent debit-card fee incident --- BofA planning to intitute a $5 fee per month on debit cards. Say Bank of America has about 10 million debit-card holders (a rough estimate) on which BofA levies a $5 per month fee. That is over $500 million dollars per year from just those fees. Meanwhile, just one of their chief executives is making over $200 million per year while also getting all sorts of other perks and golden parachutes and various risk removers. How about they remove about $50 million from some (about 10) of their 100-plus million dollar executive salaries instead??? Those executives (CEO's, VP's, etc.) are not worth $200 - 50 = $150 million per year --- nor 50 million per year. Almost any college graduate in economics with a few years experience could do as good a job as they are doing --- especially with all the lawyers and board of director members and others that those execs have helping them --- for additional millions in expense, I must add --- more opportunities for cost-cutting. In Conclusion : I advise you to NOT deposit any money, that you cannot afford to lose, with Bank of America. (And Chase bank and Wells Fargo bank --- mentioned in the 'Occupy Oakland' link above --- are no better.) See some of the mortgage-lending practices of Wells Fargo just before the 2007 'meltdown' --- at the bottom of this blog post on mortgage-lenders. "Bad credit? bankruptcy? no problem!" said Wells Fargo. Wells Fargo was treading quite close to the racketeering line. For more info: If you want more information on the 'Occupy Movement' and malpractice by banks, you can try WEB SEARCHES on keywords such as |

|

Bottom of this blog page on

To return to a previously visited web page location, click on the

Back button of your web browser, a sufficient number of times.

OR, use the History-list option of your web browser.

< Go to Top of Page, above. >Or you can scroll up, to the top of this page. Page history:

Page was posted 2011 Nov 07.

|