Ben Bernanke Images

Federal Reserve Chairman during

the last part of the Bush

MIS-Administration - post-2006

Ben Bernanke Images

Federal Reserve Chairman during

|

|

Home page >

Picture Categories menu >

Bush Library, Main Lobby >

This BEN BERNANKE Images page

|

INTRODUCTION: Below are images that capture some of the highlights of the Ben Bernanke years in the George W. Bush MID-administration, which ran from Jan 2001 to Jan 2009. Some will remember Bernanke for his smug, unhelpful responses to the Congress during the Sept-Nov 2008 hearings on the 'Paulson bailout'. When one congress-person asked him a reasonable question about the 'toxic assets', Bernanke simply answered that they were too complicated to explain (REEEaaally, Ben? ALL of them!) and immediately displayed a smug smile. The UNhelpfulness of Bernanke's testimony was only outshone by the high words-to-information ratio --- and the same 'too complicated' reply, used over-and-over-and-over again --- in the testimony of the Treasury Secretary, Henry 'Hank' Paulson. In contrast to the Bernanke & Paulson, the testimony of FDIC chairwoman Sheila Bair was so clear, yet reasonably detailed, and demonstrated such clear thought processes that she made Paulson and Bernanke look like numbskulls or crooks --- or both. For MORE Images and Data: For more images (and data) for this wing, see the WEB SEARCHES section below. Those searches may suffice in case I never return to add to the pictures on this page. |

Youth :

Yes, but I didn't inhale.

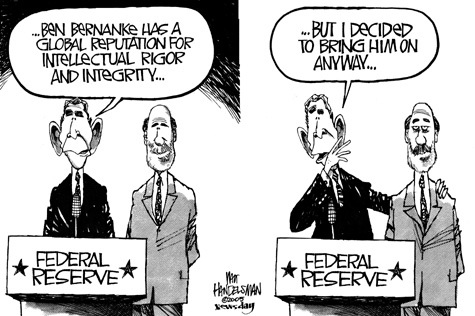

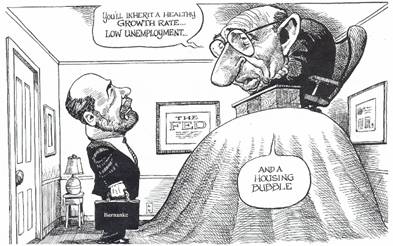

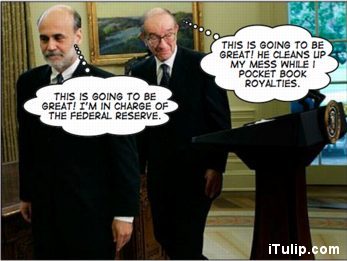

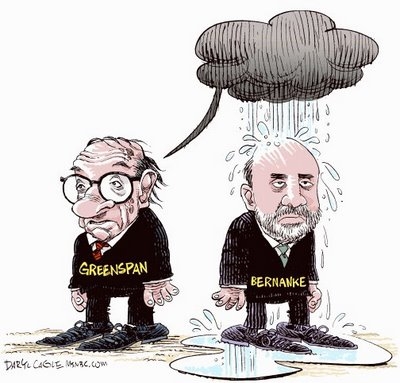

Bernanke replaces Greenspan as Fed Chairman :

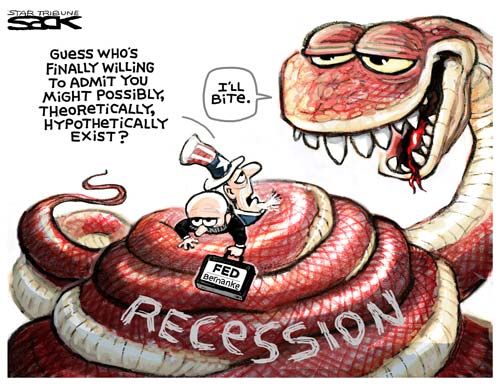

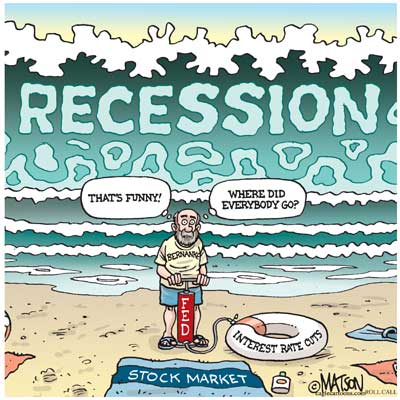

Bernanke oversees several rounds of

rate cuts as the stock market tanks

in early to mid 2008

(the unprecedented volatility begins) :

In 2008, it was revealed that

when you get ratings from the rating agencies,

you have to do a little conversion in your head.

Triple A = Triple D.

(In other words, the rating agencies were in

'cahoots' with the mortgage lenders & packagers.)

Bernanke & Paulson presenting & defending

the "Paulson Plan" in Congress, Sep-Nov 2008 :

You can see more exhibits, focused on Paulson, in the Paulson wing.

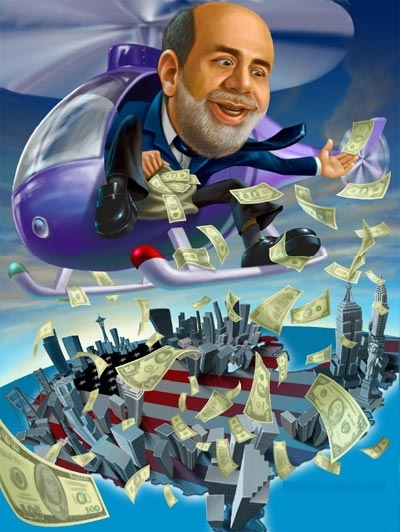

Bernanke explains the Paulson-Bernanke method

of supporting the economy.

The 'something he said' could have been the way Paulson

answered the Congress men and women's questions.

In an answer, he would talk for 20 minutes

and say two basic things :

1) "The toxic assets are too complicated for you to understand."

and

2) "I welcome oversight." [left unsaid: because I know oversight by a

Congressional committee is no oversight at all --- and besides,

they must take complaints to the Executive branch

for remedy, and guess who's in charge there.]

Implementation of the bailout,

Nov 2008 - Jan 2009 :

Going bear hunting with Paulson is kind of like

going bird hunting with Cheney.

Don't know about the bear,

but the taxpayers sure got shot up.

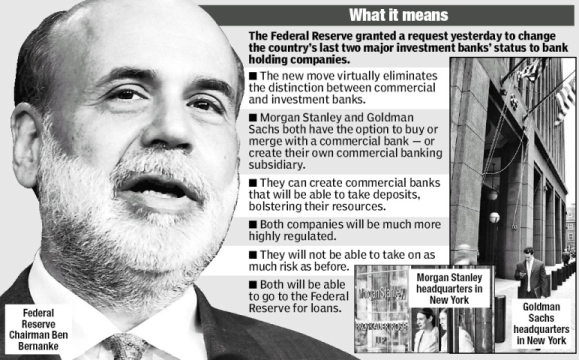

The destruction of the safeguards implemented

following the Crash of 1929 --- that is, separation

of investment institutions from bank deposits ---

is now complete.

The investment branches of the 'holding' companies

now have unfettered access to depositors' life savings.

(If you think they will be "highly regulated",

I have a bridge to sell you.)

Depositors in Bank of America & Wells Fargo

(banks that merged with investment institutions,

like BofA & Merrill Lynch), be afraid, be very afraid.

(Best to scatter your deposits --- or use the

tactic of farmers in the 1930's, bury savings in a place

you can remember, like the corner of a fenceline.)

Let the give-aways begin.

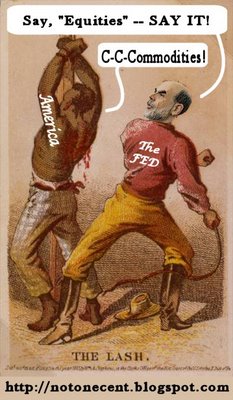

Who is controlling whom?

It appears someone is abdicating

their duty to the taxpayers.

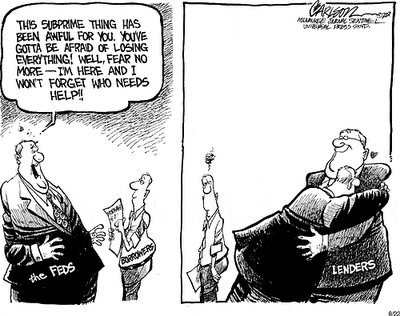

This cartoonist apparently didn't get

the message from FoxNews and CNBC.

He was supposed to be convinced that the

lenders --- who were advertising :

'Bad credit? Bankruptcy? No problem!

Get your mortgage right here!

No interest for 12 months!' ---

were being taken advantage of by

those diabolically evil borrowers.

Those hyper-aggressive borrowers were

forcing the lenders to take out those ads

in newspapers and on the Internet.

Those poor, mis-treated lenders. What could they do?

They feared for their lives. They had no choice

but to lend to those threatening married couples and

those bankrupt persons with all their friends in

high places. Millions of evil borrowers. HA!

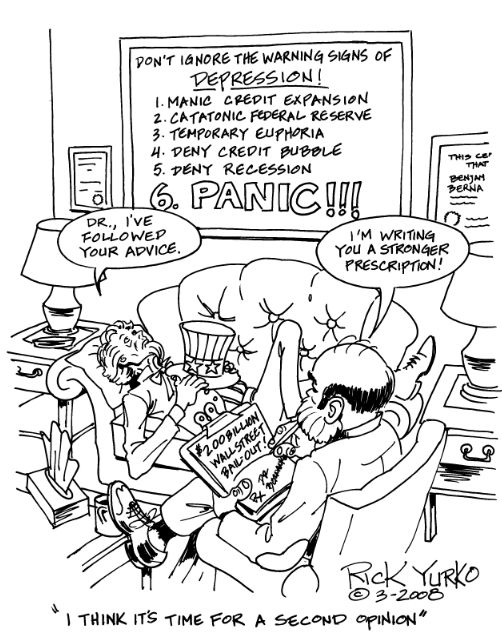

Even if it doesn't help the patient,

it makes the doctor feel like he's

done something to deserve his high-fees,

when he writes a prescription.

AND, the great thing is ... the patient

has to pay for the drug too. In this case,

1000s of dollars for every man, woman, child in the country.

See how it works?

The taxpayers get a 'stimulus' bowel cleanse.

Awwwww. Isn't it touching? Sweethearts.

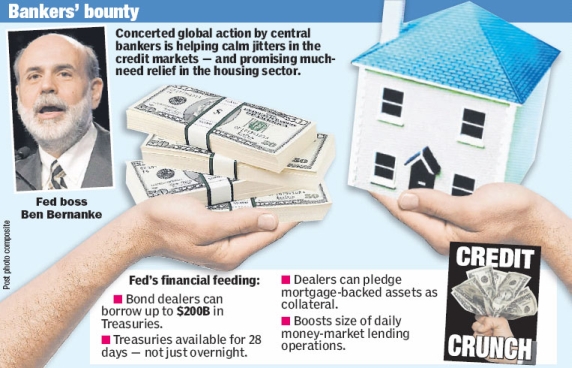

Gee, yet another group getting bailed out.

Well, where else can bond dealers get money.

The banks don't trust the bond dealers.

The banks don't trust each other.

Say ... how much of the bailoutS are

going to financial lobbyists in D.C.?

Bernanke once mentioned

dropping money from a helicopter.

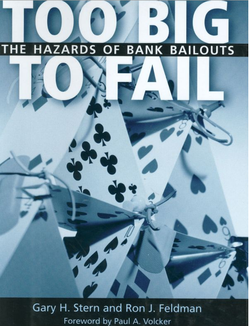

The dinosaurs seemed too big to fail too.

Seems alligators and lizards and insects and

primates and, eventually, man came through

that catastrophe.

There is a lesson there.

Let the big banks go, and

let the small banks pick up the pieces.

Betcha, in a matter of months, no one

will miss the big banks --- or their CEO's.

The Fed will get America buying bank

stocks again, even if the Treasury has to

spend the very last penny of the taxpayers' future.

The Main-Street appraiser is connected to

the Main-Street lender.

The Main-Street lender is connected to

the Mortgage-bundler.

The Morgage-bundler is connected to

the Wall-Street banks.

The Wall-Street banks are connected to

the Wall-Street debt insurers.

And the U.S. taxpayers have to bailout

the last two.

(The home-builders are in line.)

(Let the foreign investors beware.)

By the way, what happened to that plan

for taxpayers to buy mortgages?

Taxpayer, which would you rather have

--- a mortgage on a

somewhat depressed property? --- or a

(probably to-be-worthless) bank stock?

Furthermore --- why aren't banks lending

to each other, even after 350 billion dollars

of bailout? Could it be because there are still

many mortgages on their books --- and

the CEO's don't trust each other?

Then why should we trust the banks, and

their stock warrants to the Fed?

Well, the economy WAS basically sound

... once upon a time,

long, long ago (at least 7 years ago).

We will have to see how these graphs,

of the value of the dollar, 2002-2008, do in 2009.

Is this going to be the end result?

--- of the collapse of the dollar.

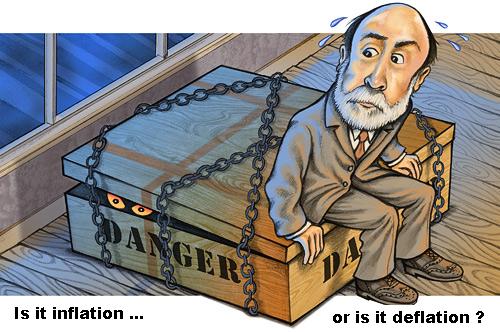

Bernanke Caricatures :

Passing the baton ... so to speak.

Is that a fish or an anchor?

Either way, it's not looking good.

Man the lifeboats. Investment robbers ...

I mean, investment bankers, lenders

(unethical as well as ethical), and

debt insurers ... first.

That brings to mind the question ---

why isn't any of the bailout money

being spent to track down & prosecute

unethical lenders?

If the Republicans in Congress managed to

gut and repeal all the pertinent laws that

could be used to prosecute them, then let

the public humiliations (preferably tar and

feathering or stoning) begin.

At the very least, let the Internet 'Halls of Shame'

begin --- such as, in galleries of this library.

Devil or angel?

|

WEB SEARCHES for It may be a long time (years or never) before I get back to this page to add more images, so here are some links to WEB SEARCHES for more images and info.

WEB SEARCH on keywords

WEB SEARCH on keywords

WEB SEARCH on keywords Also, you can go to suitable Wikipedia pages and follow links from there, such as

Wikipedia - 'Ben Bernanke#Chairman of the United States Federal Reserve'

Wikipedia - 'Emergency Economic Stabilization Act of 2008'

Wikipedia - 'Troubled Asset Relief Program'

Wikipedia - 'Subprime mortgage crisis'

Wikipedia - 'Financial crisis of 2007-2008'

Wikipedia - 'Bankruptcy of Lehman Brothers'

Wikipedia - 'List of entities involved in 2007-2008 financial crises'

Wikipedia - 'Federal takeover of Fannie Mae and Freddie Mac'

You can follow the many links in these WEB SEARCH and Wikipedia pages to find out more information on the activities of Ben Bernanke --- during the Bush years --- and before --- and after, during the Obama administration. |

|

Bottom of this To return to a previously visited web page location, click on the Back button of your web browser, a sufficient number of times. OR, use the History-list option of your web browser. OR ...

< Go to Top of Page, above. >OR you can scroll up to the top of this page. Page history:

Page was created 2009 Jan 30.

|

The way they are hunting bear,

reminds one of Elmer Fudd

hunting Bugs Bunny.