Bush BAILOUT Images

Bush BAILOUT Images |

|

Home page >

Picture Categories menu >

Bush Library, Main Lobby >

This Bush BAILOUT Images page

|

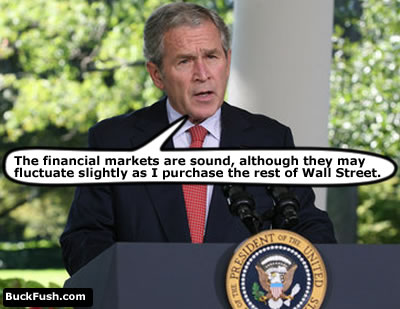

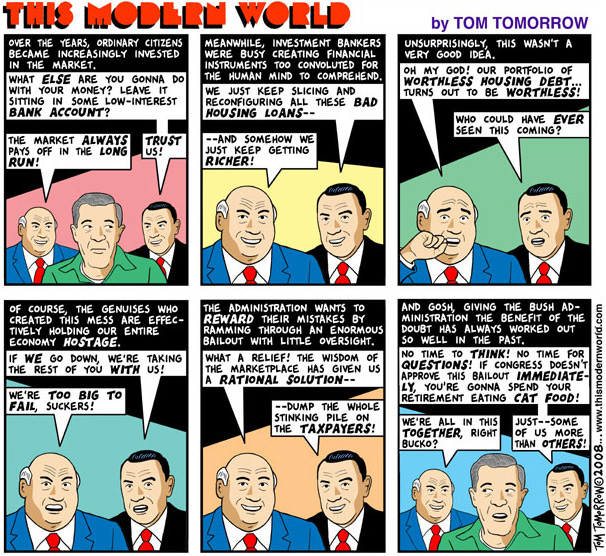

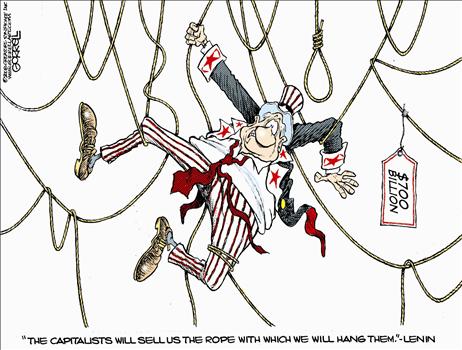

INTRODUCTION: Below are images of the George W. Bush MIS-administration, in relation to the 2008 'bailout' of 'too big to fail' financial institutions of the U.S.A. This is essentially a sub-wing of the Economy wing. This subject (the bailout --- also called "the rescue") deserves its own wing, due to its magnitude --- $700 billion, plus. Blinders on : It is almost humorous to watch Congressional hearings on CSPAN and CSPAN2 and hear congressmen, like Senator Shelby of Alabama, insist on extensive hearings to determine the causes of the financial meltdown. (It would be humorous if it weren't such a serious situation in need of so many legal and executive fixes.) It seems Senator Shelby still doesn't have a single clue as to why it happened. [Nice acting, Senator. But, as they say, the TV camera reveals all.] Apparently, Shelby missed the presentation by Senator Dorgan of North Dakota, who gave excellent examples of practices that led to the meltdown. The audio file of Senator Dorgan's presentation is available at this 'blog' web page on this site. That page also includes some examples of companies and banks who are still advertising on the Internet to offer mortgages to people who are bad risks. Apparently, there are STILL companies willing to fill in fictitious numbers, on the mortgage forms, for the borrower's income --- so-called 'liar loans'. The lenders are quite willing to make liars out of the borrowers. "Oh, you do not have to fill that in. We will do that for you." (This practice was exposed in the Feb 2009 CNBC TV documentary 'House of Cards', written by James Jacoby and presented by correspondent David Faber.) I ask you, Senator Shelby, where do you live? Under a rock? You need to get out more often. Or is it a case of the lobbyist money plugging up your ears and covering your eyes? Misplaced confidence : It defies reason that Bush, Paulson, Republican Congressmen, et. al. profess to have great confidence in the American business community and entrepreneurs, BUT they apparently don't think that the large-sized, medium-sized, and small banks (and their executives) can handle taking over the responsibilities of the 'too big to fail' banks. The executives of these smaller institutions certainly couldn't do any worse that the 'too big to fail' executives. One can bet that many of the executives of smaller banks would not think it is a good long-term business plan to advance ever more credit to people who have bad credit histories or are in bankruptcy. And they would probably not think it is a good idea to lend money on big ticket items like houses when the borrowers' income stream will not support the payments --- either initial payments or 'jacked up' payments.

For other library wings having to do with the Bailout, see

for his enormous contribution to the meltdown via non-regulation --- i.e. via ignoring the charter of the SEC. Other wings related to the bailout are

A Long Recovery to be Expected : Considering the state of the economy, we understand if you are not able to make a donation to the library at this time (in 2009) --- and for the next ten years or so after Bush's presidency. If you are able to make a donation to the library in about 10 years, please keep in mind that, because of the inflationary effects of printing a couple of trillion extra dollars to give to the CEO's of institutions that are 'too big to fail' (even though, by most definitions, they did fail --- or, at least, the CEO's did) a donation of at least $200 dollars will probably be equivalent to a donatation of $100 in 2009. For MORE Images and Data: For more images (and data) for this wing, see the WEB SEARCHES section below. Those searches may suffice in case I never return to add to the pictures on this page. |

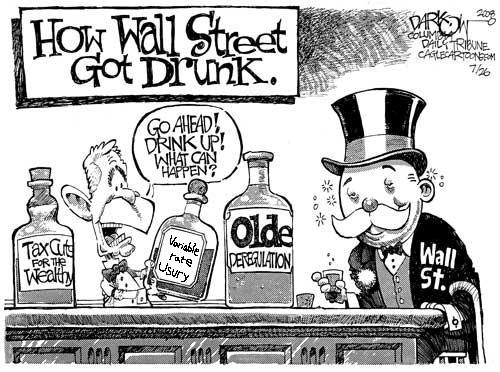

Exhibit A :

White Lightning,

Home [mortgage] Brew,

and Old Rot Gut.

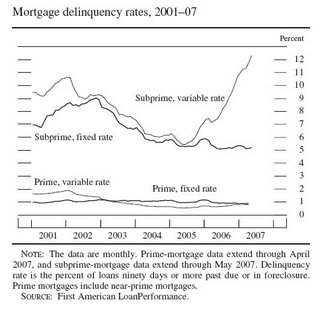

Charts and graphs :

'Subprime variable rate' mortgages

were crashing the worst.

'Prime fixed rate' and 'prime variable rate'

and 'subprime fixed rate' ... not so bad,

just before 2008.

The ups and downs of the economy.

Productivity was going down in the

2004 to 2008 period, just before the crash.

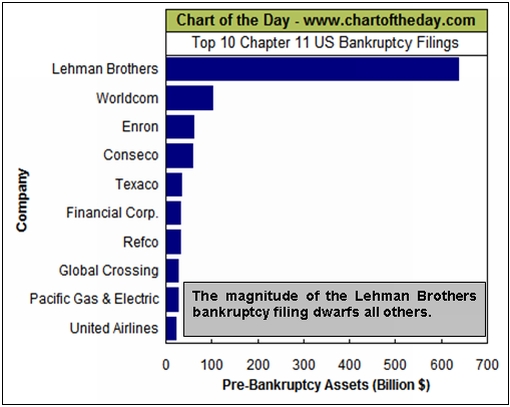

The Lehman Brothers bankruptcy was bigger

than Worldcom and Enron, in terms of

assets involved.

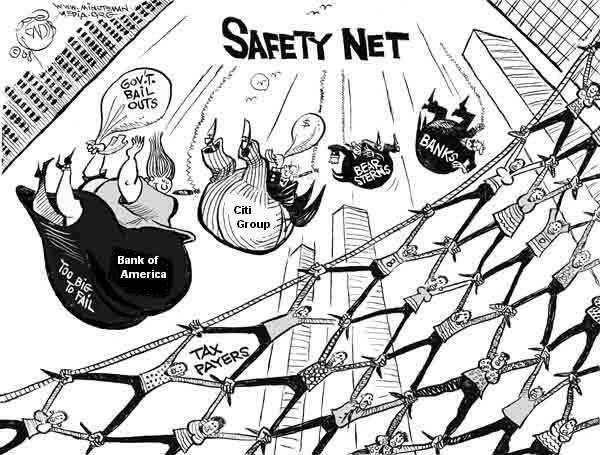

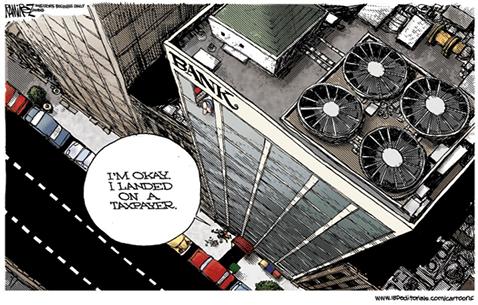

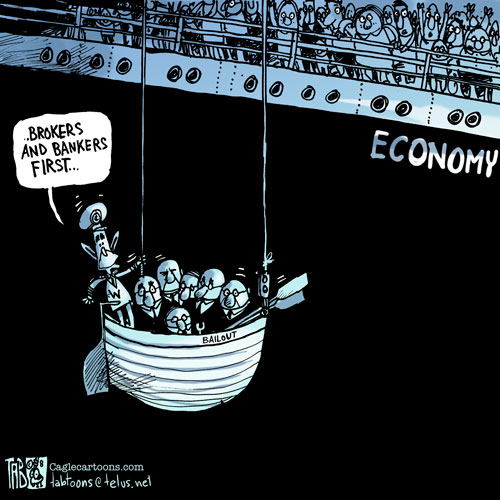

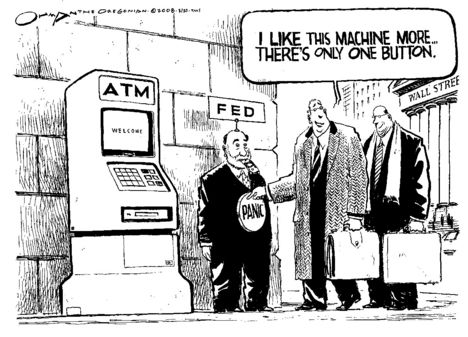

It hurts if you don't keep laughing :

As usual, the taxpayers are the safety net

for corporate indiscretions and gambling.

Kids imitating their elders.

Does not bode well for the future.

HELP ME HELP MYSELF

to your money!

NO BANKER LEFT BEHIND.

(It's always the small print

that gets you.)

|

WEB SEARCHES FOR It may be a long time (years or never) before I get back to this page to add more images, so here are some links to sample WEB SEARCHES for more images and info.

WEB SEARCH on keywords

WEB SEARCH on keywords

WEB SEARCH on keywords

WEB SEARCH on keywords Also, you can go to suitable Wikipedia pages and follow links from there, such as |

|

Bottom of this To return to a previously visited web page location, click on the Back button of your web browser, a sufficient number of times. OR, use the History-list option of your web browser. OR ...

< Go to Top of Page, above. >OR you can scroll up to the top of this page. Page history:

Page was created 2009 Feb 16.

|